Japan's Finmin Suzuki: Japan in constant touch with US on currency market

Reuters reports that the Japanese authorities are in constant touch with their US counterparts and stand ready to take appropriate action in the currency market against

volatile yen moves, Finance Minister Shunichi Suzuki said on Tuesday.

''In a post-cabinet meeting news conference, Suzuki also said he saw no contradiction between the government's yen-buying currency intervention and the Bank of Japan's ultra-loose monetary policy.''

Key notes

No comment on daily forex moves.

Forex rates move on various factors.

Ready to take appropriate actions on fx market movements if necessary.

Excess fx volatility by speculative trading is unacceptable.

Watching fx moves with high sense of urgency.

In constant touch with US authorities.

Aware of Yellen's comment that she did not know about Japan's intervention.

Excessive fx volatility due to speculative trading amplifies impact on households, businesses, must be smoothed out.

No comment on whether intervened in fx market.

Various currencies, not just yen, weak against dollar's solo strength.

Need to make sure economic measures are not delayed after ex-economy minister Yamagiwa's resignation.

Monetary policy up to BoJ to decide.

Price hikes are caused by global commodity inflation and weak yen.

Weak yen accounts for half of recent price hikes in Japan

Monetary policy and fx intervention are not contradictory.

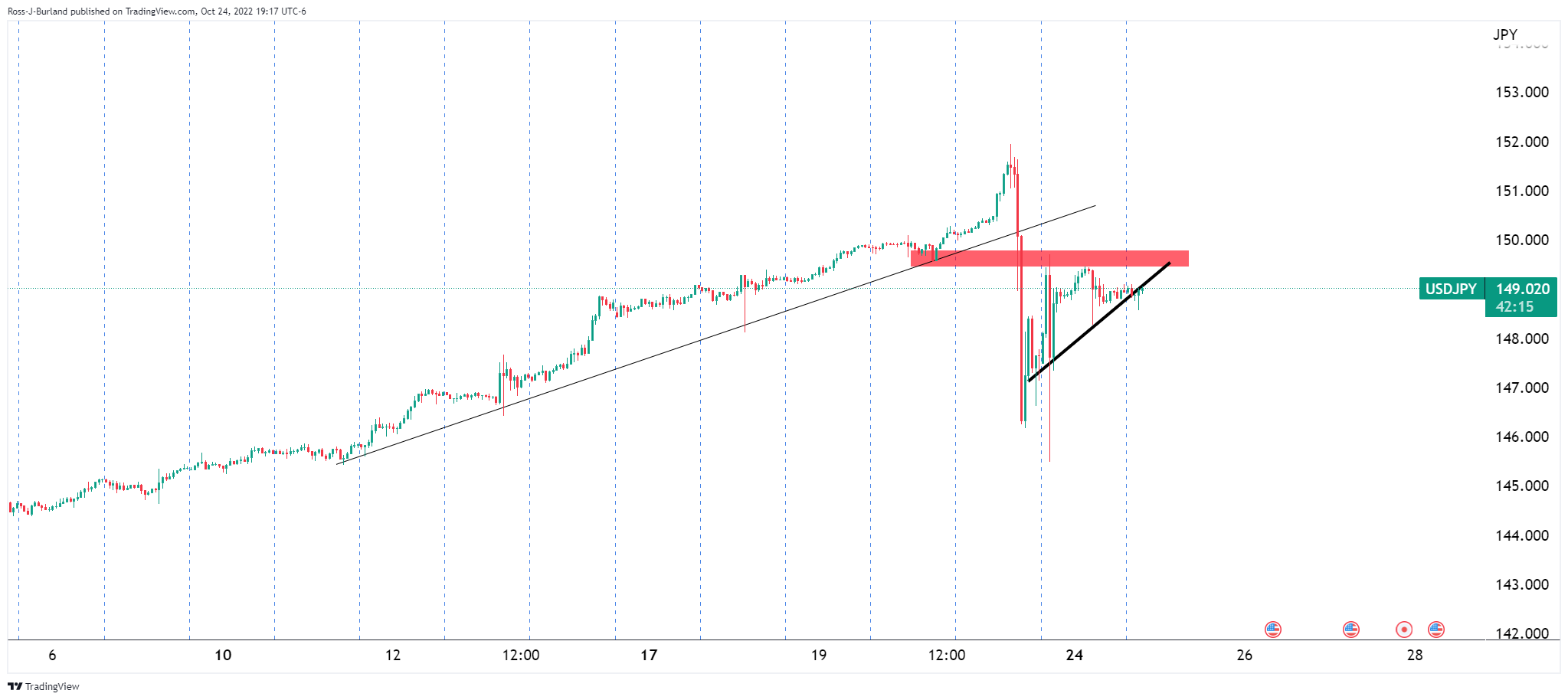

USD/JPY update

The pair is coiled and a breakout could be on the cards with the downside favoured while on the backside of the trendline.