USD/JPY trades volatile as Trump imposes 24% tariffs on Japan

- US President Donald Trump decided to impose 10% tariffs to all imports and a 24% specifically on Japan.

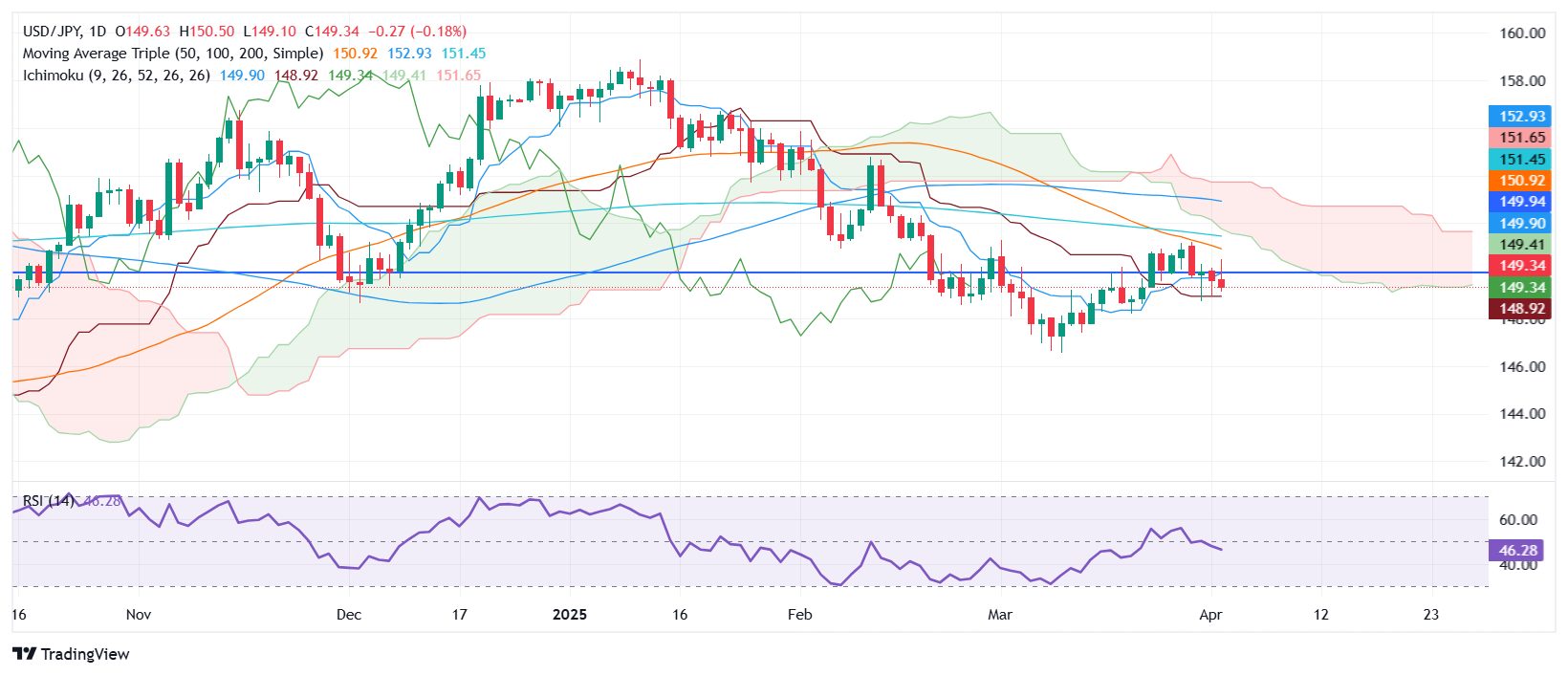

- USD/JPY seesaws within the 149.00 - 150.48 range amid Trump’s speech in the White House.

The USD/JPY trades volatily as US President Donald Trump announces reciprocal tariffs on Liberation Day, with duties being effective on April 3. The pair trades within the 149.09 – 150.48 range as Trump speaks, virtually unchanged.

Key takeaways:

US President Donald Trump announced that the US will impose 10% tariffs on all imports and 25% duties on automobiles. These duties become effective on April 3.

Reciprocal tariffs are being applied to some countries. China’s being hit with 34% duties, the European Union with 20%, 46% to Vietnam, 24% to Japan, and 10% to the United Kingdom.

USD/JPY reaction

The USD/JPY initially hit through the 150.00 figure, before Trump showed a chart with duties imposed to other countries. After that, the USD/JPY plunged over 35 pips, as traders seeking safety, bought the Japanese Yen.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.