Back

17 Feb 2020

AUD/NZD Price Analysis: H&S in the making, consolidation between 1.0390/1.0460 expected

- AUD/NZD has a near-term bias to the downside while below 1.0460.

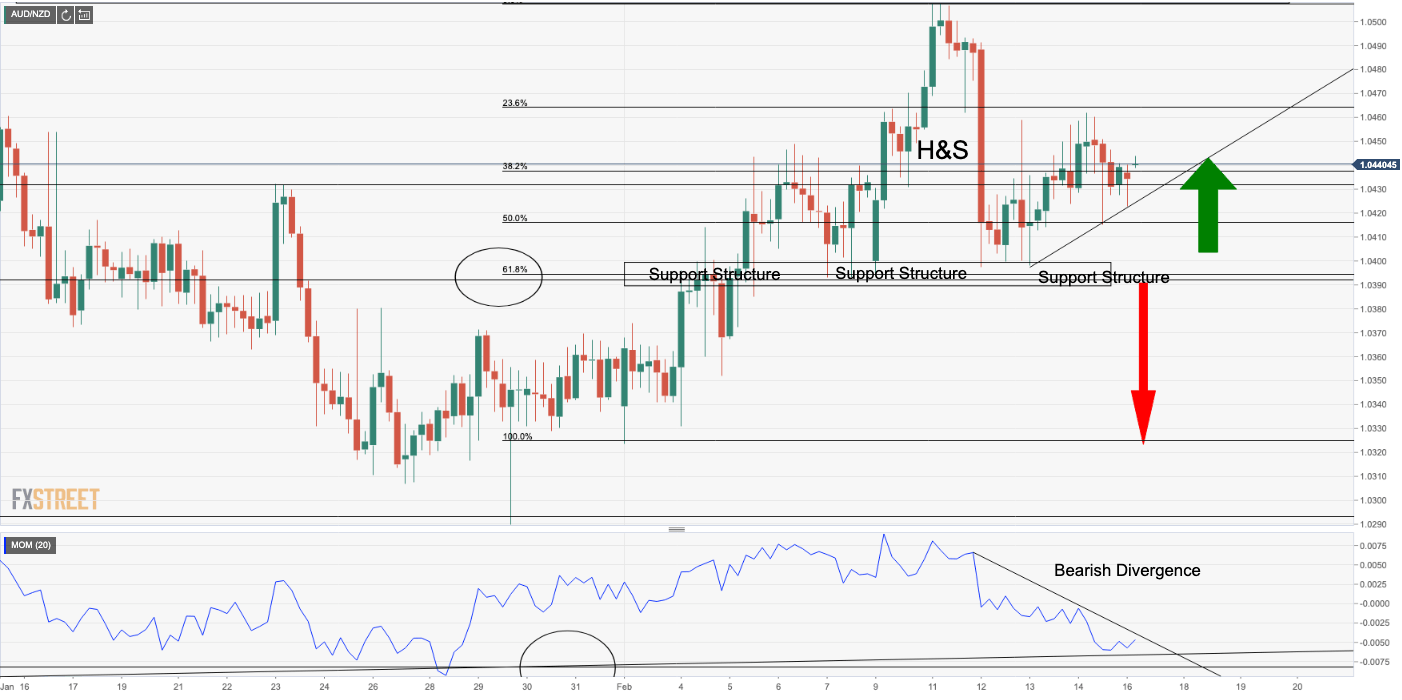

- 4-hour Bearish divergence vs daily bullish divergence seen capping immediate bullish longer-term prospects away from the weekly support structure.

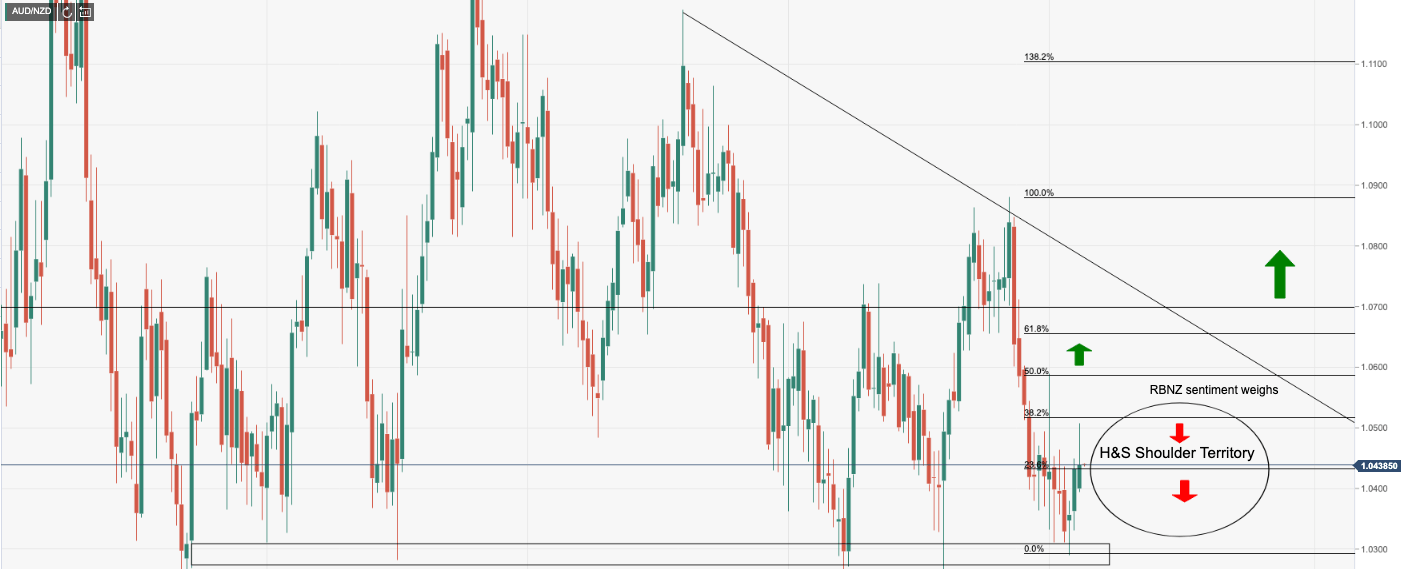

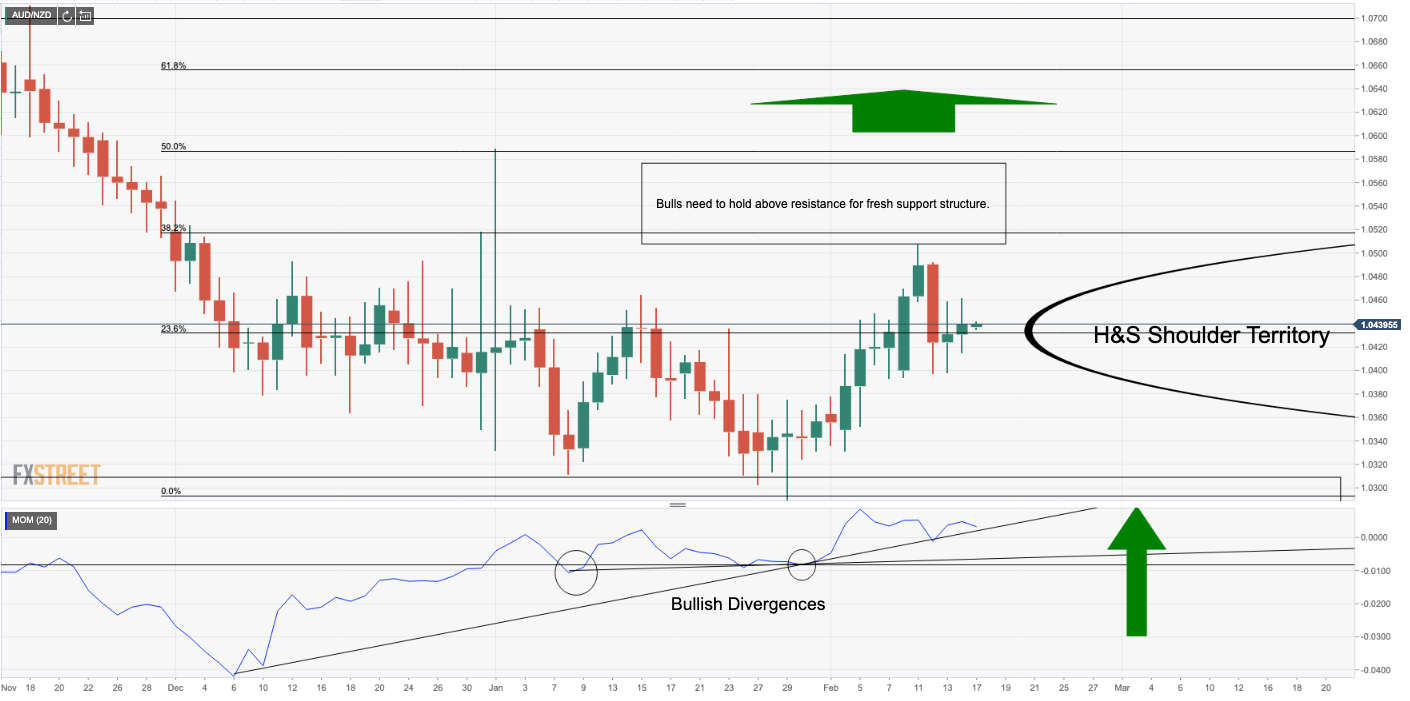

- H&S structures playing out on both longer-term and short-term charts.

As er prior analysis, AUD/NZD has been recovering from a major support structure and subsequently penetrated the 23.6% Fibonacci retracement of the daily highs through buy stop liquidity. This is in line with bullish divergence, a buy-signal for a prolonged bullish correction towards a 38.2% Fibo target at 1.0523, a 50% mean reversion in the 1.06 handle and a 61.8% Fibo target through the 1.0850s.

The big picture

Daily bullish divergence

4HR set-up

However, considering the bearish divergence on the shorter-term time frame, the near term price action could be on the verge of a test of the trendline support to target the 4-hour support structure at 61.8% Fibo, below a 50% mean reversion. This supports an outlook for consolidation between 1.0390/1.0460.