When are the UK retail sales and how could they affect GBP/USD?

UK Retail Sales Overview

The UK retail sales, scheduled to be published later this session at 0930 GMT, are expected to come in at 0.7% MoM in January, following -0.6% seen in December. Total retail sales are seen arriving at 0.7% over the year in the reported month, down from 0.9% booked previously.

Meanwhile, core retail sales, stripping the basket off motor fuel sales, are seen rebounding 0.8% MoM while rising by 0.4% YoY.

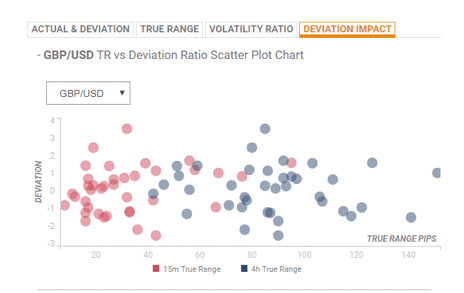

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 70 pips in deviations up to 3.5 to -1.5, although in some cases, if notable enough, can fuel movements of up to 100 pips.

How could it affect GBP/USD?

FXStreet’s Analyst Haresh Menghani notes: “From a technical perspective, the recent rejection slide from 50-day SMA and a subsequent slump back below the 100-day SMA on Wednesday might have already set the stage for a further near-term depreciating move. Hence, a fall back towards challenging YTD lows, around the 1.2870 region, now looks a distinct possibility. Some follow-through weakness might prompt some aggressive technical selling and pave the way for a slide towards testing sub-1.2800 levels.”

“On the flip side, immediate resistance is now pegged near the 1.2955 region, which might attract some fresh selling and keep a lid on any meaningful positive move. That said, a sustained strength might prompt some short-covering and assist the pair to aim back towards reclaiming the key 1.30 psychological mark,” Haresh adds.

At the press time, the Cable continues to trade under pressure around 1.2900, -0.13% on the day. The mixed market sentiment amid coronavirus headlines and EU-UK post-Brexit trade tussle remains a weight on the major.

Key Notes

GBP/USD: Near-term depreciating move

Forex Today: Long-term extremes for EUR/USD, USD/JPY, AUD/USD, Gold amid coronavirus fears, USD rally

Daily Technical Outlook on Major - GBP/USD

About the UK Retail Sales

The retail sales released by the Office for National Statistics (ONS) measures the total receipts of retail stores. Monthly per cent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive, or bullish for the GBP, while a low reading is seen as negative or bearish.