AUD/USD bulls testing bearish commitments at daily resistance

- AUD/USD bulls seeking deeper test of the daily resistance zone.

- Bears need to take out daily support at this juncture while the RBA comes as a major hurdle for AUD

AUD/USD will be the focus for the open on Monday given the economic calendar's line up which considers Chinese PMIs as the main data for today and the Reserve Bank of Australia later in the week.

On that note, analysts at TD Securities explained that Chines exports are holding up particularly well and we expect this to continue to fuel manufacturing expansion while manufacturing imports are similarly strong.

''High-frequency indicators such as refinery operating rates point in the same direction though there are signs that manufacturers are reducing inventories e.g. in steel and coal, rather than producing more.''

Meanwhile, risk appetite ended the week on a steady note which favours the bulls for the open. There was a moderate advance for most of the US session in US on Friday, but gains faded toward the end as traders squared their books for month-end and the long weekend.

Another theme playing into the price is with the Federal Reserve being of the view that inflation in the US is transitory. For now, the bond markets are buying into that guidance which pressures the US dollar.

On Friday, the US 10-year Treasury yield was lower at 1.5807% from 1.61% late on Thursday, compared with 1.6310% at the end of April.

With all that being said, the dollar index widened its trading range on the same day, spiking to a high of 90.4410 from a low of 89.9820 only to settle around flat again at 90.0560.

This leaves the Aussie poised for a downside continuation for the days ahead of the dollar can firm again which will ultimately lead to an additional test of a breakout of the daily dynamic resistance in the DXY:

RBA in focus

The Reserve Bank of Australia could stick to its dovish tone for longer as it announces monetary policy on Tuesday considering the resurgence of Covid-19 cases in Melbourne.

The virus has yet again forced the city into a lockdown which is the fourth since the start of the pandemic.

Moreover, there has not been a great deal of new information for the bank to go on.

The April jobs report showed a slowdown in total employment but the Aussie caught a bid due to the reduction in the unemployment rate (to 5.5%), albeit thanks to a smaller participation rate.

The pivotal July meeting should garner more attention from markets when the central bank should decide on whether to roll out yield curve control to the November 2024 bond.

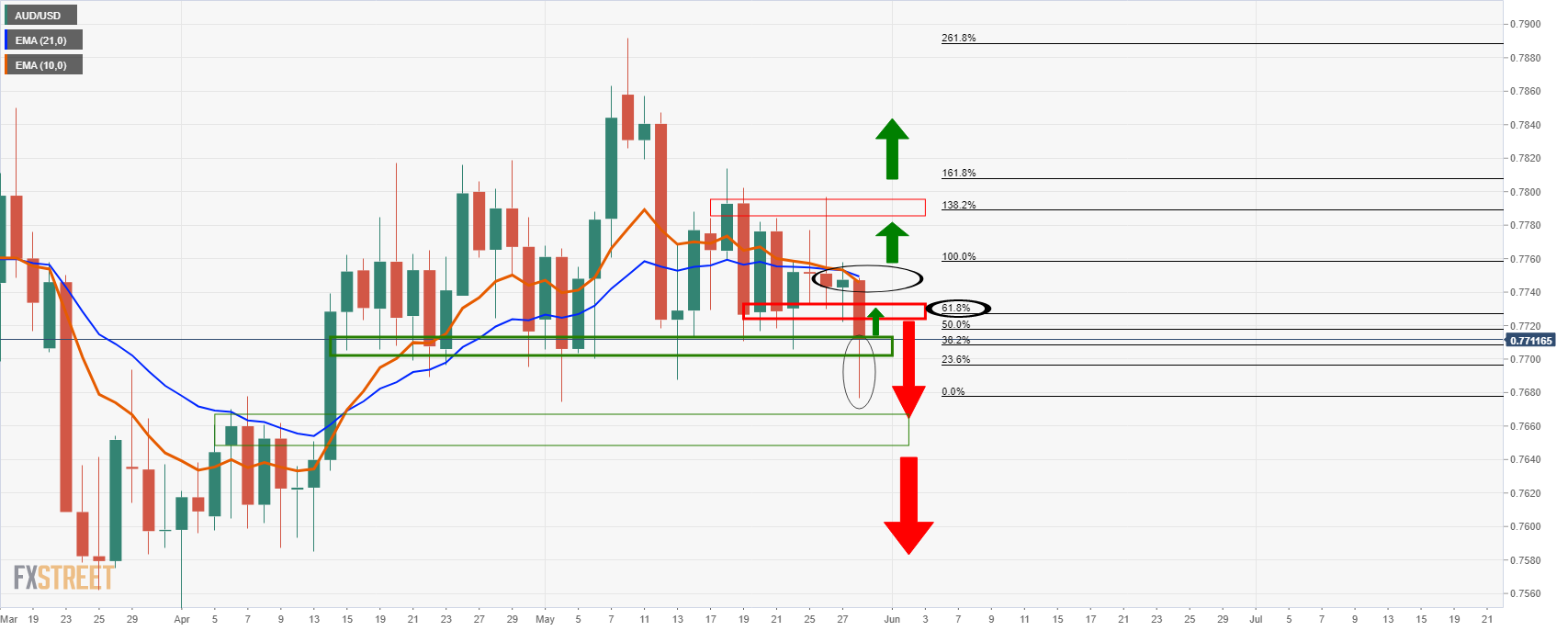

AUD/USD technical analysis

There is a risk of an upside continuation on the correction to test deeper into the resistance of the M-formation prior to a continuation to the downside.

Much will depend on how the DXY fares outside of the trendline resistance n the DXY as displayed above.