AUD/USD Price Analysis: Committed and late bulls were knocked down to size, eyes on RBA Lowe, 0.7200/0.7150

- AUD/USD bulls have been thrown back by the bears as the US dollar firms.

- The price of AUD/USD is now in a phase of consolidation.

- RBA Lowe is speaking at the top of the hour.

governor Philip Lowe is speaking at the top of the hour which could be some further volatility into the pair in what has already been a turbulent time for the Aussie. Lowe is appearing before the House of Representatives Committee on Economics which could give some insight into the path of rate hikes to come from the central bank.

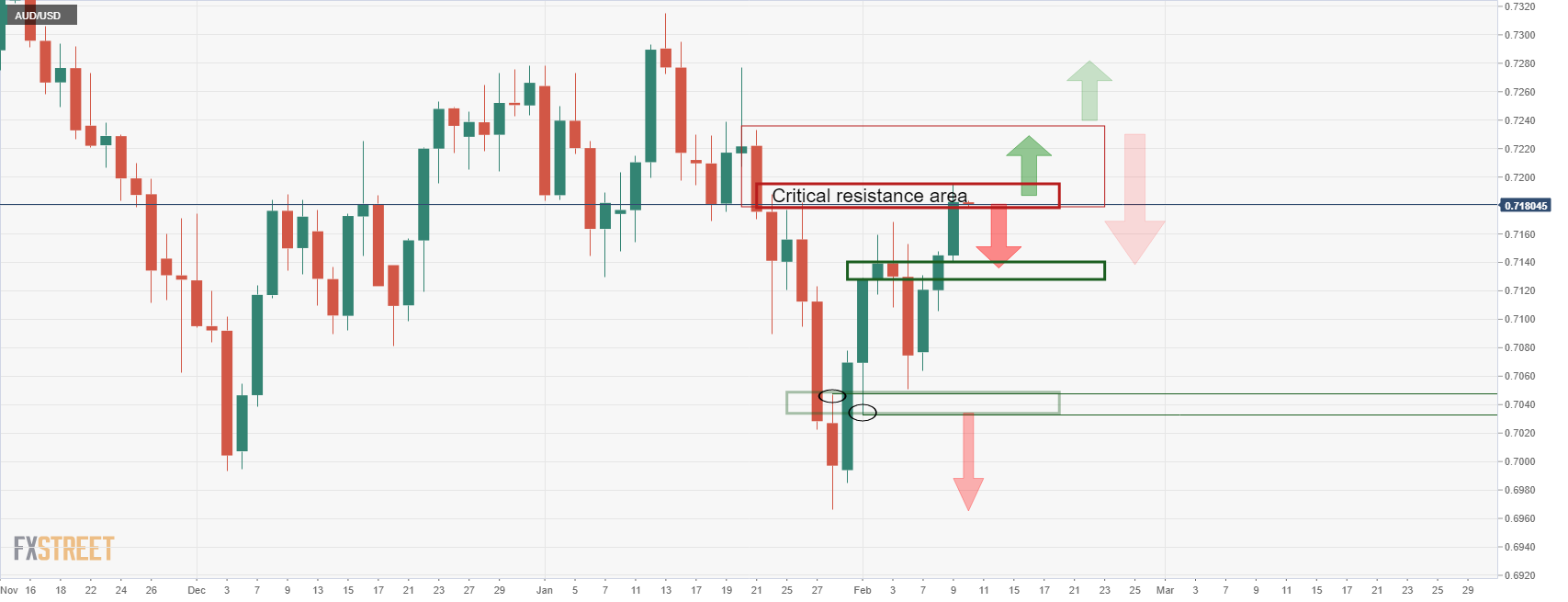

AUD/USD H1 chart

0.7200 and 0.7150 are key levels for the rest of the week.

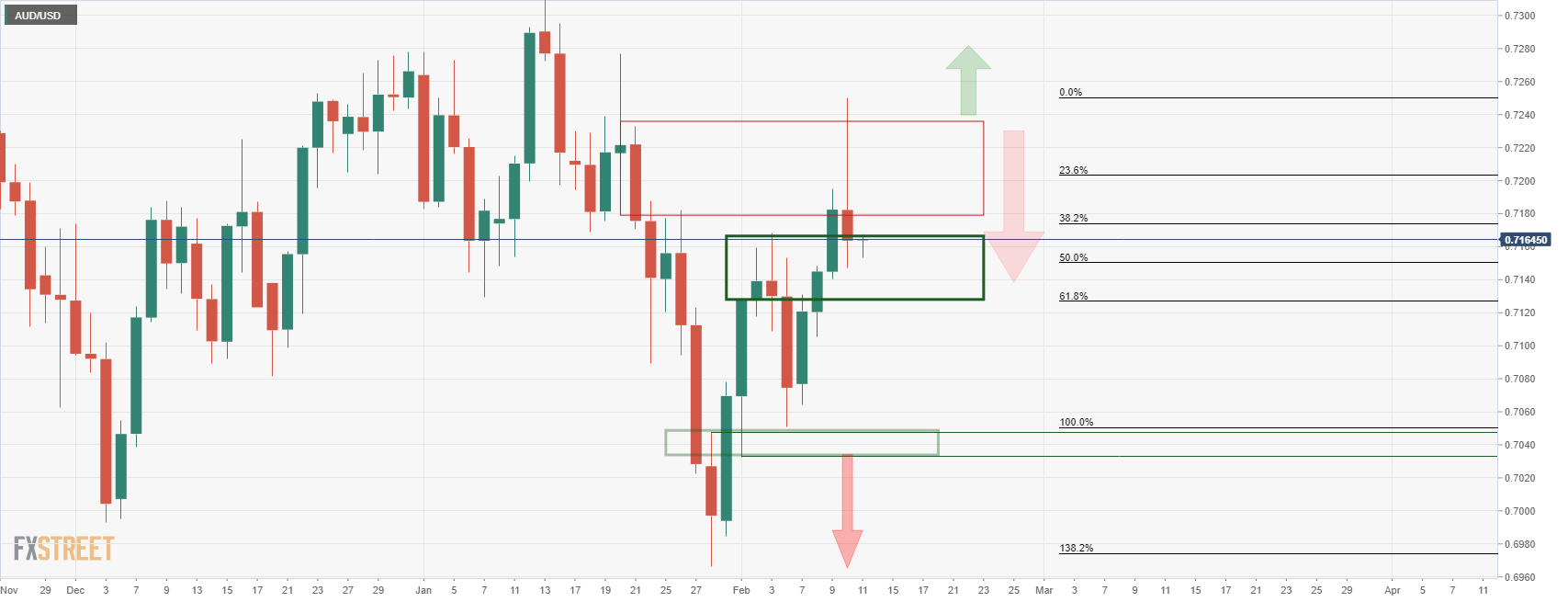

Meanwhile, as per the pre-US inflation data analysis from the prior session, AUD/USD Price Analysis: Bulls eye a break of 0.72 the figure, the price has followed suit, initially testing the 0.72 figure before crashing back into the bear's layer again, as follows:

AUD/USD prior analysis

The price broke the critical resistance area as follows:

However, the W-formation was always going to be problematic for the bulls as explained in the prior analysis. The price has subsequently fallen back into the old highs where it would be expected to consolidate as traders muddle through the various implications of sky-high inflation on a macro scale.

Bar any fundamental shock, such as an emergency rate hike from the Federal Reserve or some coordinated agreement between global central banks, the greenback would still be expected to remain underpinned. With that being said, the commodity currencies could fare well against the higher inflationary backdrop.