Spread dan syarat terbaik kami

Ketahui selanjutnya

Ketahui selanjutnya

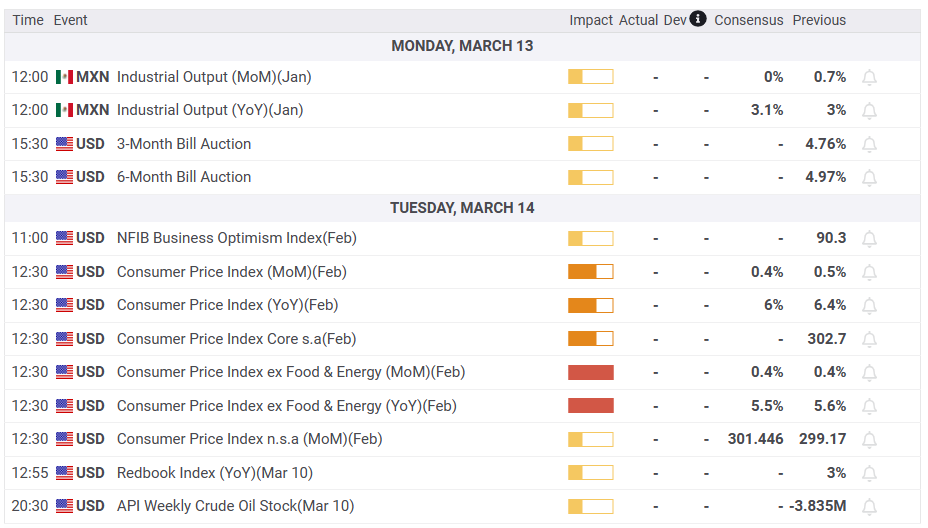

USD/MXN is almost flat after hitting a daily high of 18.5964, though a mixed US employment report weighed on the US Dollar (USD). However, the USD/MXN is still clinging to its gains, up 0.12%, trading at 18.3707.

Sentiment remains sour on US domestic issues about the failure of the Silicon Valley Bank, which overshadowed US economic data. The US Bureau of Labor Statistics (BLS) revealed the February US Nonfarm Payrolls report, with figures exceeding expectations of 225,000, as the US economy created 311,000 jobs. Although data suggests further tightening by the Federal Reserve, the Unemployment Rate was 3.6%, higher than the forecasted 3.4%, indicating a softer labor market.

The previous month’s data was revised lower from 517,000 to 504,000. Average Hourly Earnings increased by 4.6%.

Meanwhile, the US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, drops 0.87%, is at 104.365. US Treasury bond yields are plunging across the board, with the 10-year yield down almost 20 bps, at 3.712%.

Reflection of the above mentioned is traders assessing a less aggressive Fed, compared to Powell’s speech on Tuesday. Money market futures estimates a 25 bps rate hike in March and foresee the first rate cut by the year’s end.

The lack of economic data in the Mexican docket keeps traders leaning on sentiment news. US Regulators shut down the Silicon Valley Bank, as the FDIC has seized the bank. Read more here!

The USD/MXN has shifted neutral to downward biased after buyers reclaimed the 20-day EMA at 18.3247. The US jobs report assisted the Mexican Peso (MXN) and capped the rally that printed a weekly high at 18.5964, shy of the 50-da y EMA at 18.6442. As the New York session progresses, Friday’s candlestick turns to an inverted hammer, which could form an evening star pattern. A further downside in the USD/MXN is expected if that scenario plays out. For a bearish continuation, USD/MXN sellers need to reclaim $18.15. On the flip side, buyers keeping the USD/MXN exchange rate above the 20-day EMA would remain hopeful of testing the 50 and 100-day EMAs in the next week, around 18.644 and 19.0122.