Spread dan syarat terbaik kami

Ketahui selanjutnya

Ketahui selanjutnya

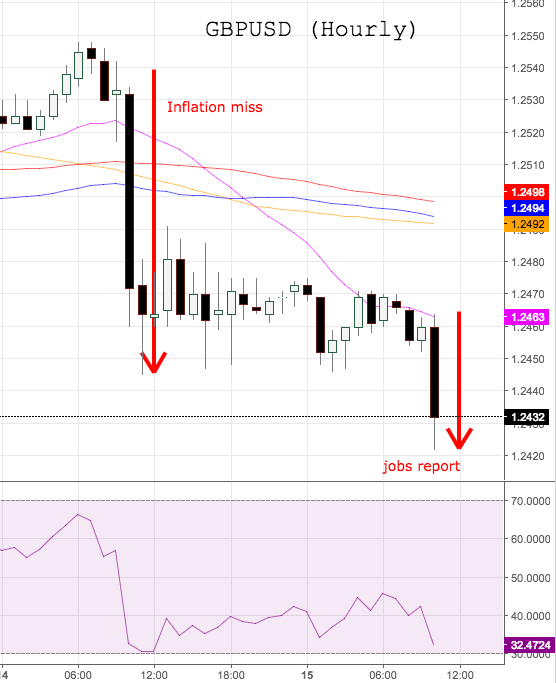

The downside pressure is mounting around the British Pound, with GBP/USD now probing daily lows in the 1.2430 area.

GBP/USD weaker on jobs data

The pair met extra selling interest after the UK’s labour market report. In fact, Claimant Count Change dropped by more than 42K jobs and the unemployment rate stayed put at 4.8% in the three months to December. However, Average Earnings including Bonus – a gauge of wage inflation – rose less than expected 2.6% during December.

GBP has quickly deflated to fresh lows in the 1.2435/30 band in the wake of the releases, which added to yesterday’s lower-than-forecasted inflation figures for the month of January. Cable is now trading in multi-day lows and remains under pressure in light of the key US docket expected later in the NA session.

In the US data space, Yellen’s testimony before the House Financial Services Committee will take centre stage once again, followed by US inflation figures gauged by the CPI, Industrial Production, TIC Flows, the Empire State index, January’s Retail Sales and the NAHB index.

In addition, Boston Fed E.Rosengren (2019 voter, dovish) and Philly Fed P.Harker (voter, hawkish) are also due to speak.

GBP/USD levels to consider

As of writing the pair is losing 0.32% at 1.2428 facing the next support at 1.2410 (low Jan.31) followed by 1.2344 (low Feb.7) and finally 1.2250 (low Jan.19). On the other hand, a breakout of 1.2572 (high Feb.7) would open the door to 1.2680 (high Jan.26) and finally 1.2715 (high Feb.2).